Robotaxi Rivals Pony.ai and WeRide Chart Different Paths to Success

Robotaxi Rivals Pony.ai and WeRide Chart Different Paths to Success(Yicai) May 22 -- Pony.ai and WeRide, two of the leading companies in China’s growing robotaxi sector, have just released their first-quarter results, with the firms relying on very different growth strategies.

The two New York-listed companies are pursuing global expansion as well as strengthening their domestic positions, but have different approaches to technology, partnerships, and revenue generation.

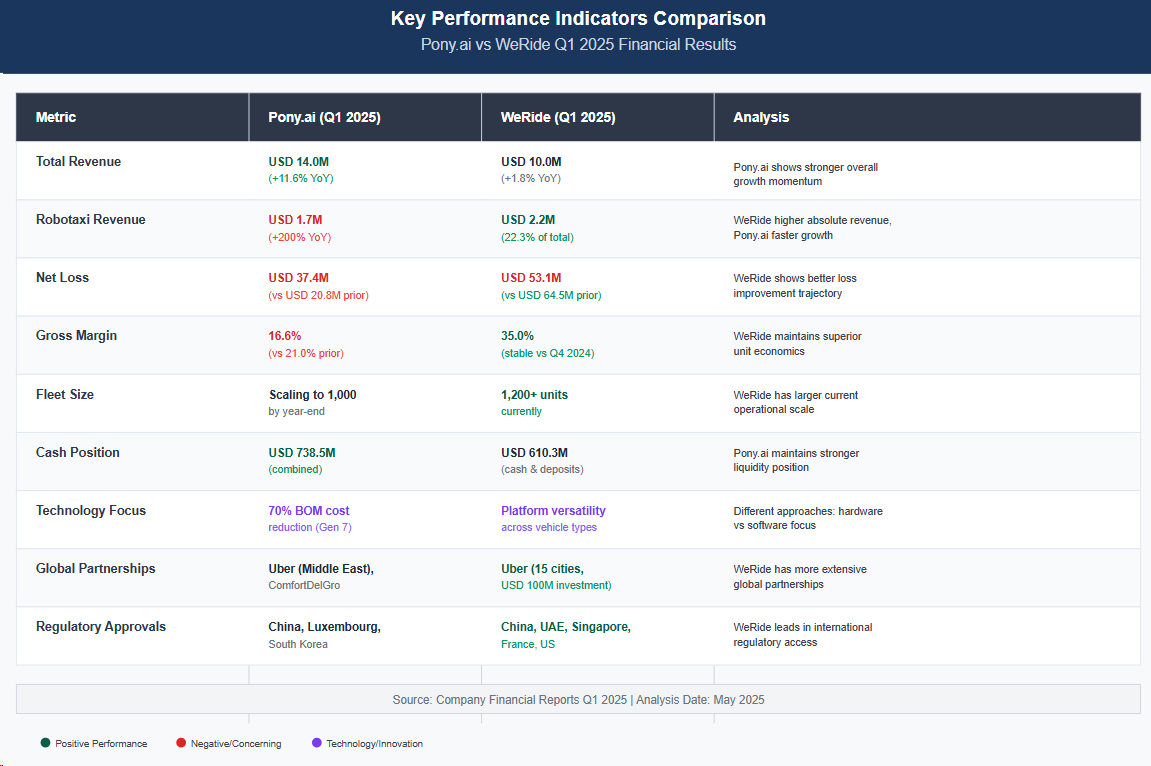

Pony.ai reported stronger results for the first quarter of this year, with total revenue reaching USD14 million, an 12 percent increase from a year earlier. WeRide’s revenue rose 1.8 percent to USD10 million.

Both companies are still in the red, with Pony.ai's net losses widening to USD37.4 million, while WeRide's net losses narrowed to USD53.1 million.

Diverse Approach

The two Guangzhou-based companies have fundamental differences in terms of technological approach. Pony.ai has adopted a hardware-based strategy, and claims that its Gen 7 self-driving system has cut bill-of-materials costs by 70 percent, while also achieving full Level 4 autonomous driving and a 600,000-kilometer lifespan.

WeRide has taken a software-first approach with its universal autonomous vehicle platform WeRide One, which is designed to be used for multiple vehicle types and different environments. The platform supports robotaxis, robobuses, robovans, and robosweepers, offering potential revenue diversification that Pony.ai's narrower focus lacks.

Global Expansion

Both companies are aggressively pursuing international markets, but through different partnership plans. Pony.ai has forged strategic alliances with Uber Technologies for Middle East deployment and Singapore-based transport company ComfortDelGro for Southeast Asian markets, securing L4 testing permits in Luxembourg and beginning road tests in the Gangnam district of Seoul.

WeRide's global strategy appears more comprehensive, with operations approved across five countries: China, the United Arab Emirates, Singapore, France, and the United States.

The company announced an expansion of its partnership with Uber earlier this month, with plans to cover 15 more cities globally over the next five years, backed by an additional USD100 million equity commitment from Uber. WeRide has also launched fully driverless testing in Abu Dhabi and introduced 24-hour autonomous ride-hailing in central areas of the Chinese city of Guangzhou.

WeRide has an advantage in terms of fleet size, operating over 1,200 robotaxies. Pony.ai aims to reach 1,000 by year-end and said it has the necessary production capability and supply chain arrangements to reach this goal.

Road Ahead

Both companies have substantial cash reserves, with Pony.ai having secured USD738.5 million in combined cash and investments, while WeRide has USD611 million in cash equivalents.

But profitability remains elusive. In the first quarter, Pony.ai increased its Gen 7 investment and WeRide expanded its research and development spending by 17 percent, reflecting the heavy capital requirement for technological progress and market expansion.

Success will likely depend on speed of execution, navigating regulatory hurdles, achieving operational scale and technological leadership. Pony.ai's manufacturing focus may enable faster scaling, but WeRide's platform diversity could provide more resilient revenue streams.

Both also face growing competition from global tech giants and automakers that are entering the autonomous driving sector, so their contrasting strategies will soon face the market test. The winner will be determined not just by technological superiority, but by which company most effectively balances innovation with operational execution in an increasingly competitive landscape.

Editor: Tom Litting