Guangzhou Pharma Targets USD1.4 Billion R&D Push, USD2.8 Billion in Deals by 2030

Guangzhou Pharma Targets USD1.4 Billion R&D Push, USD2.8 Billion in Deals by 2030(Yicai) Dec. 29 -- Guangzhou Pharmaceutical Holdings, a leading manufacturer of traditional Chinese medicine, plans to invest between CNY10 billion and CNY15 billion (USD1.4 billion to USD2.1 billion) in research and development, and between CNY20 billion and CNY30 billion in industrial investment and mergers and acquisitions during China’s 15th Five-Year Plan (2026-2030), according to Chairman Li Xiaojun.

The planned spending reflects mounting pressure on the state-owned drugmaker to accelerate innovation and transformation amid slowing growth and intensifying competition across its core businesses. Li, who took office in November last year, outlined the strategy at an internal company meeting held on Dec. 27.

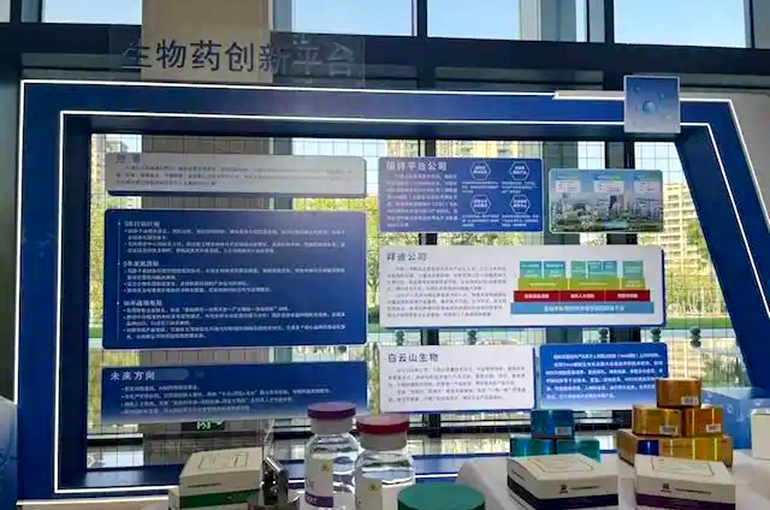

Baiyunshan Pharmaceutical Holdings, the group’s listed subsidiary, illustrates the challenge. The company’s revenue mainly comes from three business segments: Big South Medicine, Big Health, and Big Commerce. Big South Medicine focuses on pharmaceutical manufacturing, including Chinese and Western patent medicines, chemical active pharmaceutical ingredients, and biomedicines. Big Health produces beverages, food, and health products, while Big Commerce -- the largest revenue contributor -- operates pharmaceutical distribution businesses such as wholesale, retail, and import and export of pharmaceutical products, medical devices, and health products.

Big Commerce is Baiyunshan’s largest business segment by a wide margin, generating CNY29 billion in revenue in the first half of this year, or nearly 70 percent of the company’s total, but with a gross profit margin of just 6.1 percent.

The second-largest revenue source was Big Health, which recorded CNY7 billion (USD995.9 million) in revenue in the first half, with a gross profit margin of 44.7 percent. Big South Medicine ranked third, posting revenue of CNY5.2 billion and a gross profit margin of 49.7 percent, the highest among the three segments.

Growth in both the Big Health and Big South Medicine segments has been sluggish amid intensifying competition in the beverage industry and the continued rollout of China’s centralized drug procurement policy. Baiyunshan invested CNY828 million (USD118.1 million) in research and development last year, accounting for only 4.3 percent of its revenue, a relatively low level by industry standards.

Guangzhou Pharma has reached a stage where transformation and innovation are no longer optional, General Manager Chen Jiehui said. “Starting now, the company will focus on achieving best-in-class goals in selected fields and build a dual-driven business model of ‘independent research and development plus mergers and acquisitions,’ actively positioning itself in the innovative drug sector.”

Chen added that Guangzhou Pharma aims to see results from acquired companies within one to two years, from acquired pipelines within three to five years, and from independent research and development within five to 10 years.

Editor: Emmi Laine