Major Foreign Banks Lift China Growth Forecasts on Vast Tech, Consumer Sector Potential

Major Foreign Banks Lift China Growth Forecasts on Vast Tech, Consumer Sector Potential(Yicai) July 3 -- A string of major foreign banks have all raised their annual economic growth predictions for China, buoyed in particular by optimism about the huge potential of the country’s technology and consumer sectors as ramped‑up pro‑growth policies begin to take effect and the economy swiftly stabilizes after recent tariff tensions.

JPMorgan Chase, Goldman Sachs, Morgan Stanley, and Deutsche Bank have raised their forecasts for China’s gross domestic product growth this year to 4.8 percent, 4.6 percent, 4.5 percent, and 4.7 percent, respectively, increasing them by as much as 0.7 percentage point.

China set a GDP growth target of around 5 percent for 2025 at the National People’s Congress in March. The economy grew by 5 percent last year, achieving the government’s annual goal.

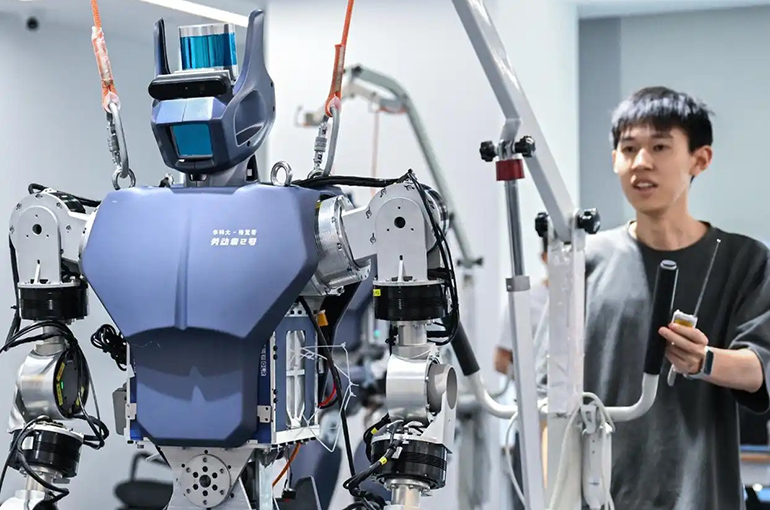

Breakthroughs by companies such as DeepSeek in artificial intelligence and others in electric vehicles and humanoid robotics have convinced global investors of their competitiveness in a multipolar world, said Wang Ying, chief China equity strategist at Morgan Stanley.

Corporate cost‑saving measures, efficiency gains, dividends, and buybacks to counter deflationary pressures have also won investor approval, he noted.

AI is one of history’s biggest investment opportunities, while long‑term themes such as power and resources and the “longevity economy” also merit attention, according to Hu Yifan, chief investment officer for China at UBS Wealth Management.

New consumption fields, such as interest-driven consumption, quality retail, and cultural tourism, have also been doing well in China, said Zhu Haibin, chief China economist at JPMorgan Chase.

Cultivating new consumption scenarios can stimulate demand through supply, according to Lu Ting, chief China economist at Nomura Holdings. For example, the recent surge in popularity of the Jiangsu Football City League has spurred the demand for local hospitality, dining, and cultural tourism, Lu noted.

To achieve its 2025 growth target, China should further strengthen its economic policies in the second half, accelerate fiscal spending, introduce more policies to steady the stock and real estate markets and the Chinese yuan, according to analysts. There is also still room to further lower interest rates and the portion of funds that banks need hold in reserve, they noted.

Editor: Futura Costaglione