Chinese Battery Giant Eve Energy to Spend USD454 Million on New Malaysia Plant

Chinese Battery Giant Eve Energy to Spend USD454 Million on New Malaysia Plant(Yicai) July 8 -- Eve Energy, a major Chinese battery producer, said a unit will invest CNY3.3 billion (USD454 million) building a new factory in Malaysia to meet fast-growing demand for energy storage and consumer batteries.

The plant will be build in Kulim, Kedah state within two and a half years, Huizhou-based Eve Energy said late on July 5, adding that it is subject to approval by Chinese and Malaysian regulators.

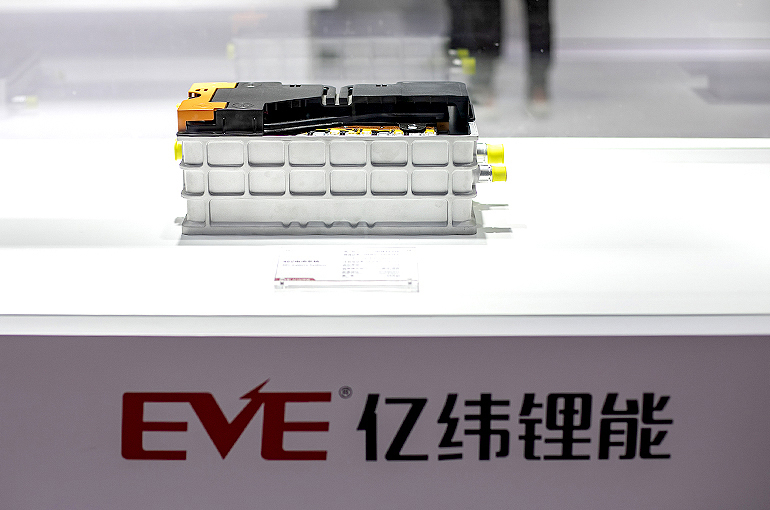

The factory will increase Eve Energy's annual production of square and cylinder lithium-ion batteries and promote its overseas expansion, the company noted, without disclosing further details such as the plant's capacity.

A combination of strategic factors, governmental support, industrial capabilities, and increasing demand for renewable energy and consumer electronics is making Malaysia and Southeast Asia an important region for the production and consumption of energy storage and consumer batteries. There has been an influx of investment by Chinese companies in the market in recent years.

Eve Energy is cranking up its capacity to turn out products overseas. Construction work on a plant for commercial vehicle power batteries in the US state of Mississippi began at the end of last month. The company and partners such as Daimler Truck invested will invest as much as USD2.6 billion in the factory, with the Chinese firm holding a 10 percent stake.

In a separate announcement on July 5, Eve Energy also said it will provide equipment and related services to the Mississippi plant and will likely earn up to USD23 million in revenue from it by the end of this year.

Eve Energy shipped 28.08 gigawatt hours of power batteries and 26.29 GWh of energy storage batteries last year, with overseas sales accounting for 27 percent of its total revenue, according to the firm’s annual earnings report. It was the world's third biggest for energy storage battery shipments for the second straight year, it noted, citing InfoLink and the Shanghai Metals Market.

Shares of Eve Energy [SHE: 300014] closed 3.2 percent down at CNY36.24 (USD4.98) apiece in Shenzhen today. They have fallen 14 percent since the end of last year.

Editor: Martin Kadiev