Short-Term CD Rates Fall Below 1% in China

Short-Term CD Rates Fall Below 1% in China(Yicai) Jan. 19 -- Interest rates on new certificates of deposit maturing in less than a year have generally fallen below 1 percent at most Chinese lenders.

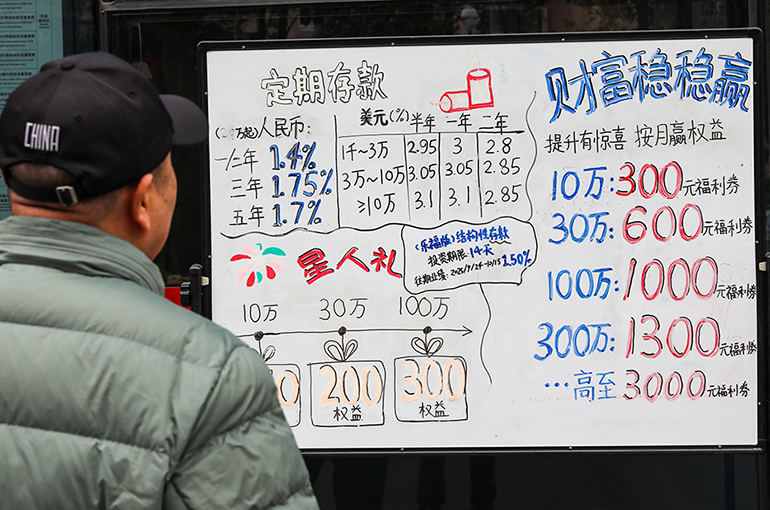

Most newly issued CDs with maturities of less than a year now carry interest rates of below 1 percent, while one-year and three-year CDs are generally offer below 1.5 percent and 2 percent, respectively, according to data from nearly 50 banks compiled by the China Foreign Exchange Trade System.

Financial institutions estimate that about CNY75 trillion (USD10.77 trillion) worth of deposits will mature this year.

Alongside low rates, CD maturities are also shortening. Most banks are promoting products with terms of one year or less, and CDs with maturities of five years or more have largely disappeared from the market. For example, China Construction Bank only offers CDs with tenors of no more than 12 months, while Bank of China has CDs with maturities of six months as well as one, two, or three years.

Most Chinese CDs have a minimum deposit of CNY200,000 (USD28,720), though higher‑minimum products have also appeared. Industrial and Commercial Bank of China, for instance, launched a three-year CD with an annual interest rate of 1.55 percent and a minimum deposit of CNY1 million (USD143,600). It has already sold out.

Many depositors are also moving funds from large banks with lower rates to smaller and mid-sized banks offering higher yields, Yicai found.

A three-year deposit of CNY300,000 with an interest rate of 1.65 percent at a big bank yields CNY14,850 (USD2,130) in interest, Li Wei, a depositor in Shenzhen, told Yicai, noting that the same amount yields 1.85 percent at a city commercial bank and earns an extra CNY1,800 in interest.

Li plans to combine her year-end bonus with the money from maturing deposits to make a CNY500,000 investment with a nearby city bank, she said.

Some banks are trying to retain existing funds and attract new depositors by temporarily raising interest rates. For example, Guangdong Huaxing Bank recently launched a three-year CD with an annual rate of 1.95 percent for new customers. Some private banks are also offering CDs with annual rates above 2 percent for specific clients.

Given current net interest margins -- the difference between the interest a bank earns on its loans and investments and the interest it pays on deposits and other funding -- the trend of reducing deposit costs is likely to continue, according to Ming Ming, chief economist at Citic Securities. But with deposit rates already low, the pace of future cuts may slow, he noted.

Besides directly lowering rates, banks are expected to cut long-term, high-yield offerings and raise minimum deposit requirements for high-interest CDs, Ming added.

Compared with CDs, money market funds still offer a modest yield advantage, averaging 1.12 percent last year, according to data from Wind Information. Assets in such funds grew to CNY14.66 trillion (USD2.1 trillion) at the end of the third quarter of last year from CNY13.2 trillion at the start of the year, per the Asset Management Association of China.

Editor: Futura Costaglione