China Adds to Gold Reserves for Ninth Straight Month in July as Forex Stash Dips

China Adds to Gold Reserves for Ninth Straight Month in July as Forex Stash Dips(Yicai) Aug. 8 -- China increased its gold reserves in July for the ninth month in a row, while the country's foreign exchange reserves fell due to the appreciation of the US dollar.

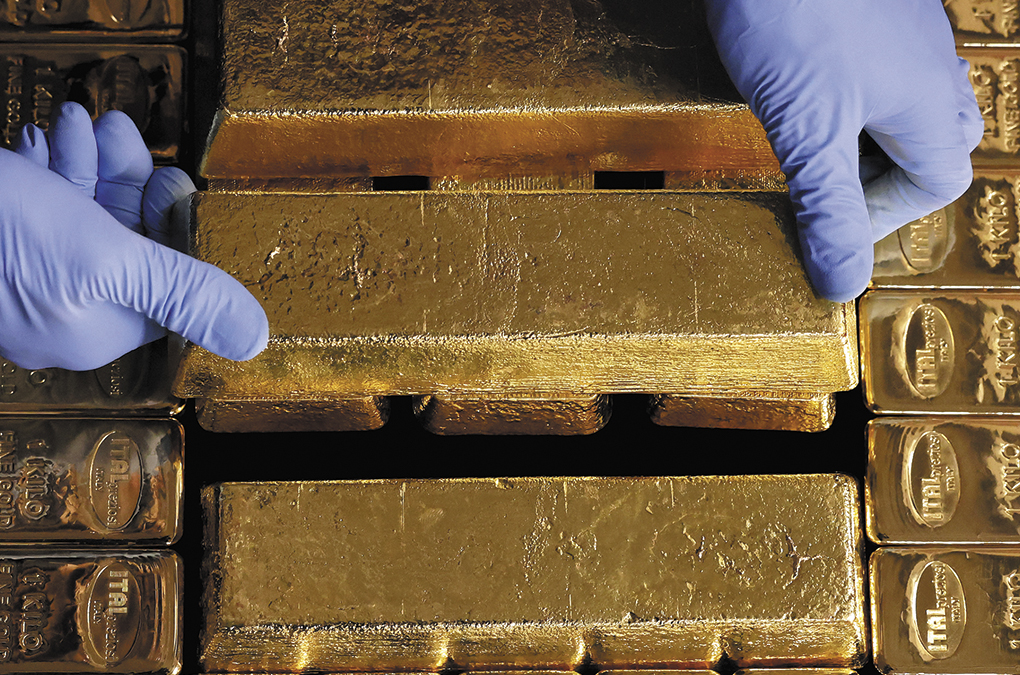

The People's Bank of China increased its holdings of gold by 60,000 ounces to 73.96 million ounces last month from June, according to data released by the State Administration of Foreign Exchange yesterday. By value, the reserves rose by about USD1 billion to USD244 billion.

Since last November, China's central bank has bought 1.16 million ounces of gold.

International trade frictions have cooled, lessening the demand for safe-haven assets and leading to an adjustment in the gold price, which remains high, Wang Qing, chief macro analyst at Golden Credit Rating International, told Yicai.

Since the Trump administration took office in the United States the global political and economic landscape has seen new uncertainties, making the price of gold more likely to rise than fall, Wang noted, adding that there is little need for the PBOC to stop increasing its holdings.

Affected by the uncertainty of US trade policy, gold topped USD3,500 per ounce on April 22 and has since fluctuated in the USD3,100 to USD3,500 range. It was around USD3,480 today.

Gold accounts for about 7 percent of China's official reserve assets, half of the global average of 15 percent, Wang also pointed out. The main direction going forward will be to continue increasing gold holdings and moderately reduce US Treasury bill ownership, he said.

China's foreign exchange reserves came in at USD3.3 trillion at the end of last month, down about USD25.2 billion from June-end, mainly affected by changes in exchange rates and asset prices, the SAFE’s data showed.

The US Dollar Index, a measure of the greenback's value relative to a basket of other currencies, rose 3.4 percent in July, ending a five-month decline after the country reached trade deals with many nations, Wang said. This led to non-dollar assets in forex reserves to depreciate relatively, Wang pointed out.

Editors: Dou Shicong, Martin Kadiev